JV & Investments

Building a future of resilience and progress through visionary, sector-wide investments & strategic joint ventures

Investing in Arya Group offers a unique opportunity to support groundbreaking innovation and sustainability. Join us in shaping the future with cutting-edge technologies across defense, energy, and aerospace. Our strategic global partnerships propel growth and success, ensuring that your investment contributes to a brighter, more sustainable world.

SHARE US ON

M7 Investments – driving infrastructure development

At M7 Investments, based out of Dubai, UAE, a key initiative of Arya Group, we are dedicated to managing funding for essential infrastructure projects. Our focus includes supporting domestic aerospace funding and aircraft procurement, highlighting our commitment to advancing the aviation sector. With our expertise in airport management and telecom infrastructure setup, we strive to foster growth and innovation in these critical areas. M7 Investments plays a vital role in shaping a sustainable future, ensuring that our infrastructure meets the demands of tomorrow.

Key investment sectors

- Propellant & Shell Manufacturing : Expansion into 155mm Howitzer shell production and partnerships in propellant manufacturing plant.

- Aerospace & Aviation : Investments in domestic airlines under the UDAAN Scheme include aircraft MRO services, procurement, and satellite-based surveillance.

- Telecommunications : Strategic ventures in telecommunications and network rollout projects.

- Aquaculture : Investments in aquaculture Projects based out of India & Ghana.

- Energy Solutions : Advanced hybrid solar and wind energy projects, SMRs (Small Modular Reactors), and EV charger assembly.

Market opportunity & growth

- Defense Spending Boom: Rising global defense budgets create a strong demand for ADMS’s specialized defense hardware and technology.

- Green Energy Revolution: Growing investment in sustainable energy solutions like solar, wind, and small modular reactors, where ADMS holds significant expertise.

- Technological Advancement: High growth potential in AI, IoT, and cybersecurity markets.

Market opportunity & growth

- Defense Spending Boom: Rising global defense budgets create a strong demand for ADMS’s specialized defense hardware and technology.

- Green Energy Revolution: Growing investment in sustainable energy solutions like solar, wind, and small modular reactors, where ADMS holds significant expertise.

- Technological Advancement: High growth potential in AI, IoT, and cybersecurity markets.

Our investment companies

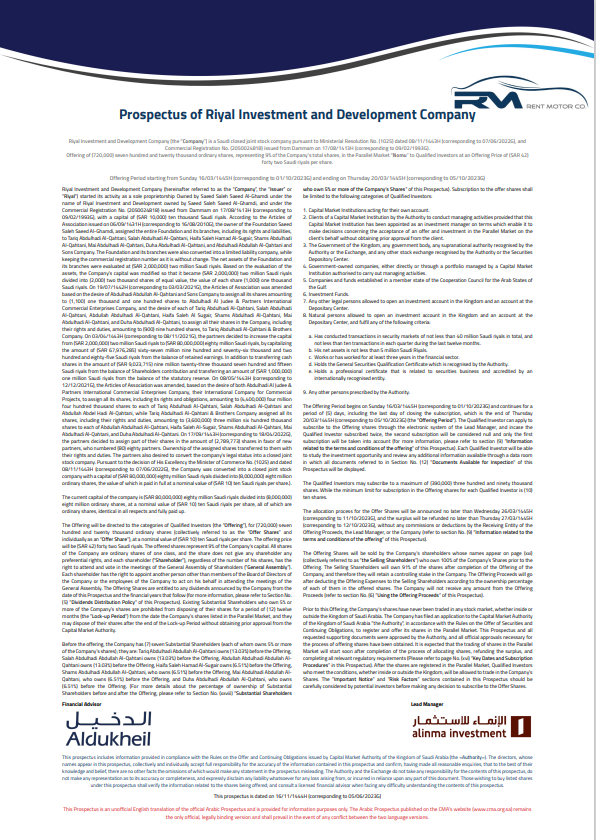

Riyal Investment and Development Company, a Saudi-based closed joint stock company, is making strides in the Parallel Market (Nomu) with a share offering that represents 9% of its capital. Established in 1993, Riyal began as a sole proprietorship under Saeed Saleh Saeed Al-Ghamdi and has since evolved into a robust entity with a capital of SAR 80 million. The company is known for providing long-term and short-term vehicle rental services to large institutions, as well as selling both new and used vehicles. This offering invites qualified investors to purchase shares at SAR 42 each, with a total of 720,000 ordinary shares available. Investors can participate through the company’s lead manager during the offering period, with a minimum subscription of 10 shares. With a solid history and clear vision, Riyal aims to leverage this offering to expand its market presence and foster long-term growth in the automotive and investment sectors.

Our joint venture companies

Schutzcarr

Read More >

Harrow Snake MARP

Read More >

Black Eagle Air

Read More >

Harrow Security Vehicles

Read More >

Kvertus

Read More >

Accoutre

Read More >

Ammunition

Read More >

Bowasag

Read More >

Investment opportunities

Partnerships & joint ventures

Highlight opportunities for co-investments, strategic partnerships, and technology collaborations.

Join Us >

![3bff078c-6b38-423a-8608-f8c5fc2d30ec [Converted] 3bff078c-6b38-423a-8608-f8c5fc2d30ec [Converted]](https://arya.org.in/wp-content/uploads/elementor/thumbs/3bff078c-6b38-423a-8608-f8c5fc2d30ec-Converted-scaled-qztcbmwca9qts5rhcstxeb07zzgbonyomi6a2wjjqk.jpg)

Capital investment

Outline opportunities for private equity, venture capital, or other forms of investment in ADMS’s growing sectors.